Red Flags Update – Is This Short Now a Long?

Plus, discrepancy alert: The Paycom Saga continues...

***Get ready for a bigger, better, reimagined On the Street... coming soon to a browser near you.***

When I added Leslie’s ($LESL) to the Red Flag Alerts last July, I kicked myself for not having done it sooner...

It had been on my list to write about, but I missed it by a week, with the company preannouncing some fairly horrific results.

The stock plunged 30% in a single day, continuing a multi-year collapse that took it perilously closer to zero.

Still, with the quality of its results getting worse, I slapped it onto the red flag list, but with one caveat:

Obviously, it's a turnaround candidate... Who knows, maybe an activist will find something here. Or maybe Leslie's will wind up back in the clutches of private equity.

After all, activists and short-sellers often use the same screens to generate ideas because they’re both looking for companies that are somehow challenged... and, as a result, often wind up taking positions in same companies.

With Leslie’s, I went on to say that it remains a “show me story,” which it still does.

Fast-Forward Seven Months

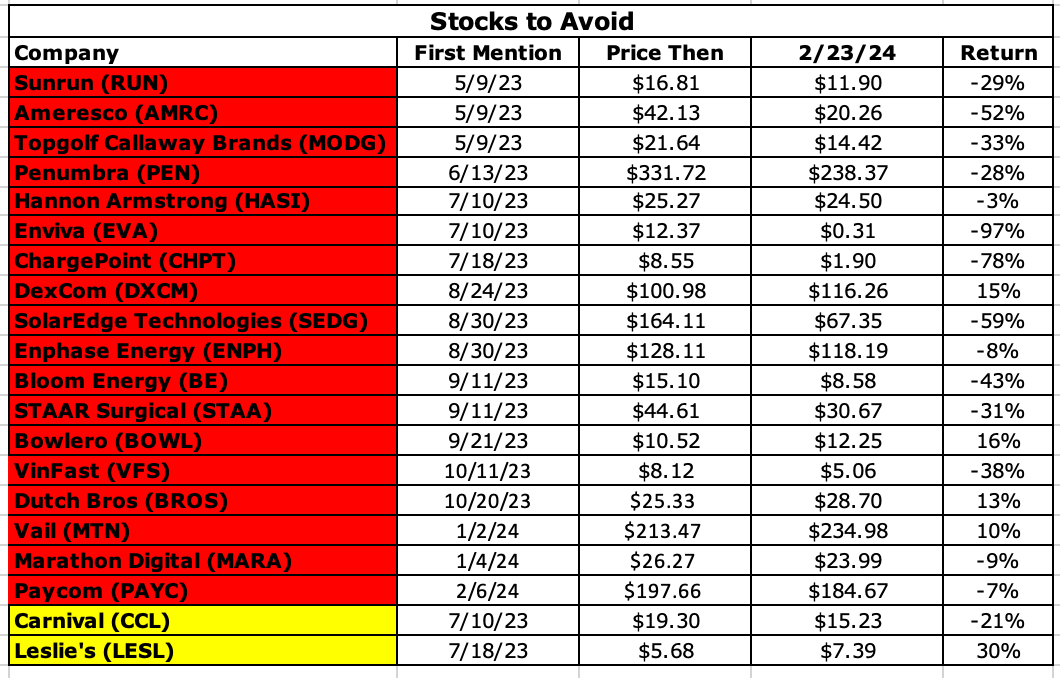

But here we are seven months later, and it’s the single-best upside performer among my red-flagged companies, up 30% as of Friday. At one point it was up more than 40%. While some of that might be the result of not having flagged it until after it had been clobbered, there very well might be something else going on...

After reassessing the company with the help of a colleague, and pondering removing it from the Red Flag Alerts entirely, I’m shifting it to a yellow flag.

There are still plenty of better stocks to own, but as good of a short as it may have once been – or at least to avoid owning – it now may actually be a better long.

The primary reason: The company is begging for an activist to get involved. Not literally begging, but considering its lackluster performance it would appear to be a perfect candidate if for no other reason... in our view, it’s mismanaged.

Not Pool People

Central to that thesis is that not a single member of the senior management team has any pool industry experience.

Instead, they’re retailers, from places like Eddie Bauer, Hibbett and Barnes & Noble, which is the tricky part of the story...

With more than 1,000 stores in 39 states, it would seem prudent to have retailers in charge.

Make no mistake: Leslie’s is a retailer. And not just any retailer: It’s the largest specialty retailer of pool supplies and equipment in a highly fragmented industry, with more than 8,000 smaller, local mom-and-pop competitors. Also in the mix are the likes of Home Depot, mass marketers like Amazon and Walmart.

At the same time, Leslie’s is in the pool industry, which would seem to require an expertise of its own. From an investment perspective, that pits it against Pool Corp ($POOL), a wholesale distributor whose stock market performance and overall execution has left Leslie’s in the dust.

So much so that Pool Corp appears to be seizing on Leslie’s misfortunes with an acquisitive eye toward the retail space, which is ripe for consolidation. A little more than two years ago Pool Corp acquired the Pinch A Penny chain of pool supply stores, which have a strong concentration in Florida, with an eye towards growing in Texas – two prime markets for Leslie's.

Why Is One Better?

Pool Corp itself has been involved in bull/bear tug-of-wars over the years, but I kept wondering: Why is it that much better than Leslie’s?

While they’re two very different businesses – they are both in an industry that benefits from a higher installed pool base, very strong recurring revenue trends and private label sales – it would appear that Leslie’s should be doing well.

Leslie’s flailing started almost right out of the gate since going public during the market frenzy of 2020… it’s second go-round as a public company. In its latest IPO, it was spun off by private equity, which was clearly taking advantage of money pouring into the stay-at-home boom in all things home improvement. The PE firm, which had loaded the company with debt, was clearly the smart seller.

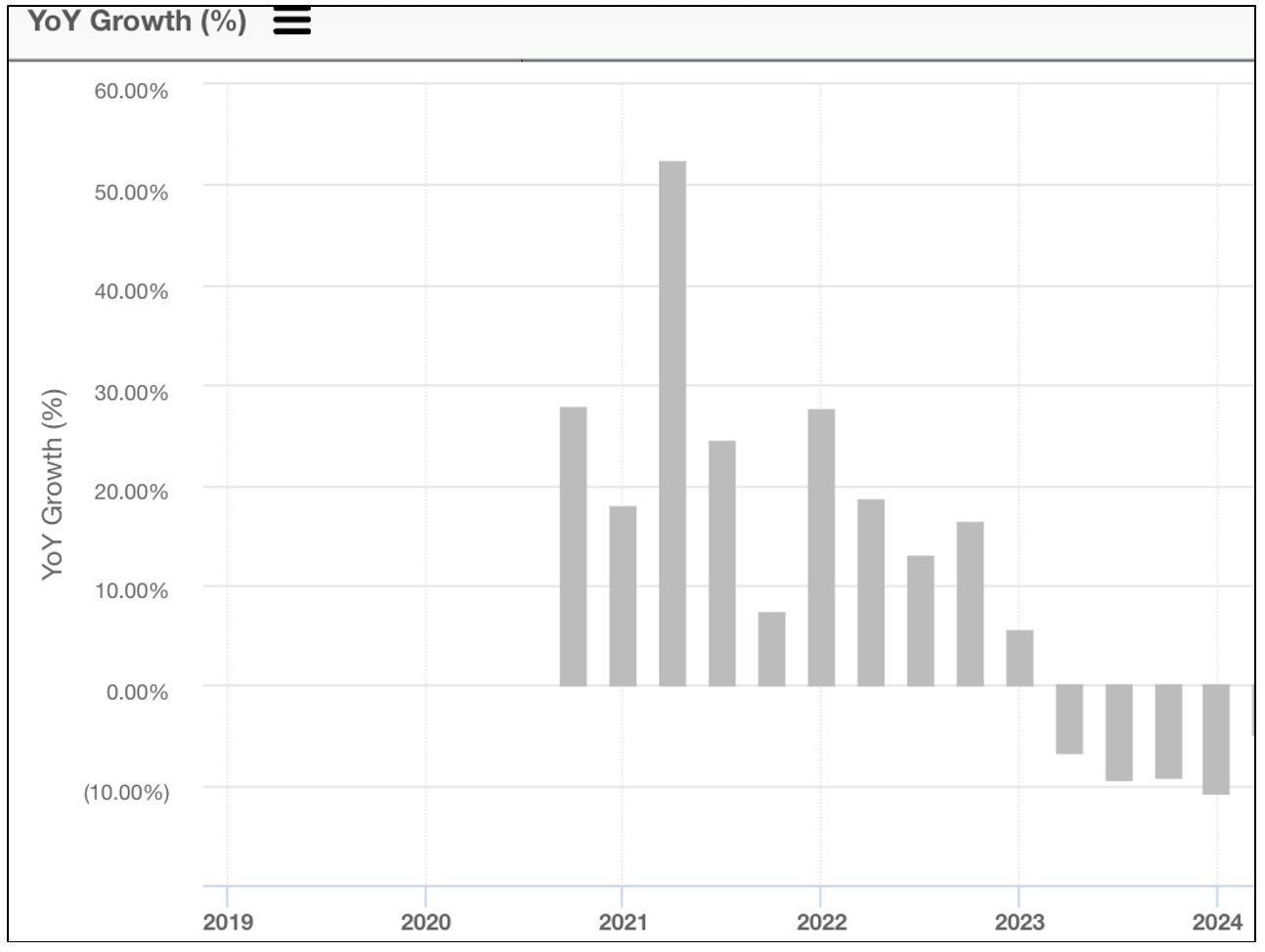

The chart below tell the story, starting with Leslie’s revenue growth since it has gone public...

Part of the weakness, to be fair, is tough comps versus the pandemic-fueled surge.

But the company has also suffered from what appears to be mismanagement of its chlorine inventory... resulting in a pull-forward of sales.

Stuffed with Inventory

For example, in August of 2023 Leslie’s said its results were negatively impacted by three years of highly unstable supply and price inflation, leading people to stockpile. However, during its second quarter May 2023 conference call, CEO Michael R. Egeck acknowledged sales had been boosted after the company had sent a letter to customers warning of a chemical shortage and them to buy early. Or as he put it on last May’s earnings call

At one point last year in the first quarter, we actually sent a letter to our loyalty file, stating we couldn't guarantee product availability in the second half and urging them to purchase early before the pool season.

That, in turn led to sharply lower guidance than expected a year later.

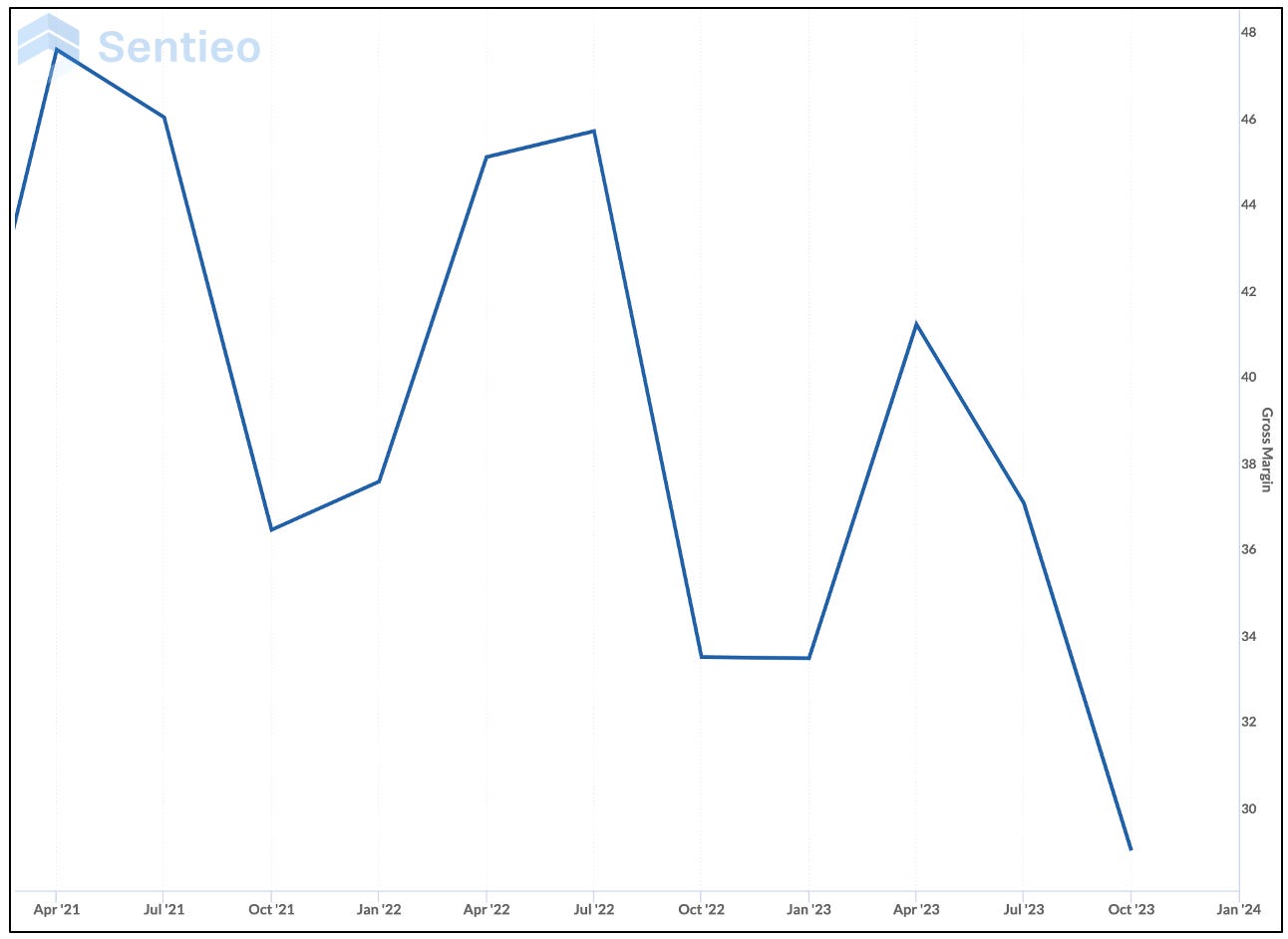

In fact, by last year’s fourth quarter Leslie’s had so much inventory that it had to store it in several third-party facilities, causing a 260 basis point hit to the gross margin.

There’s even an amended shareholder class-action lawsuit alleging that management “concealed from investors that the company and its customers had a glut of inventory, which would inevitably depress future demand.”

Expertise Matters

Which gets us back to management, and the lack of pool industry expertise...

Selling jeans and outdoor gear is far different than selling pool supplies, which can be quite technical and nuanced.

That’s why it would appear that Leslie’s subpar performance – evident in its margins – is not structural, but instead self-inflicted.

As a result, any hint of a change in top management, to include somebody with pool industry experience, would be catalyst that could spark shares.

Unless the board takes action, that no doubt would come from an activist.

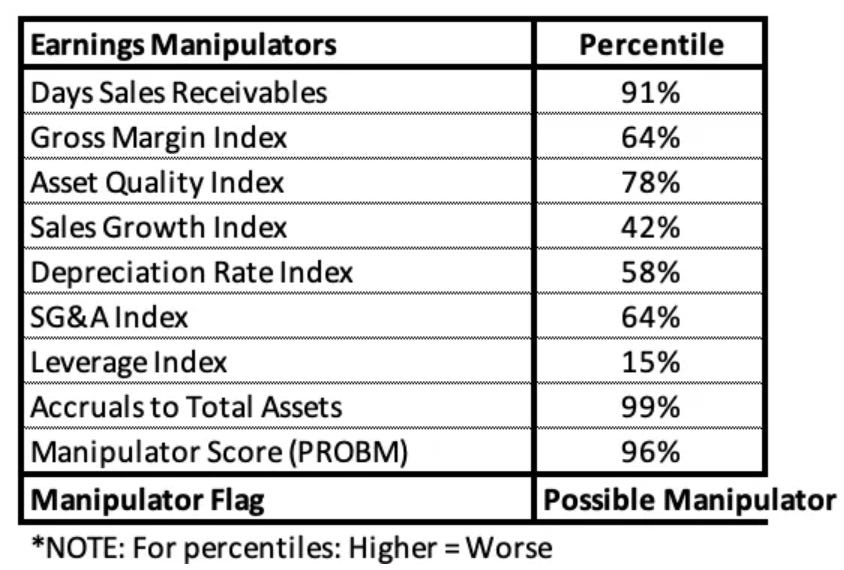

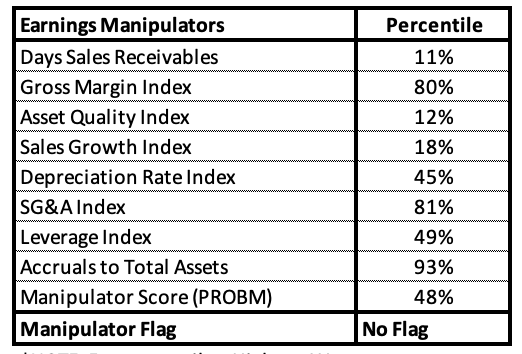

There’s something else: When I first red-flagged Leslie’s it was showing up as a possible earnings manipulator on screens from my pals at Kailash Concepts...

That’s changed quite a bit...

Bottom Line

For all its flaws, including excessive debt, the possibility of an activist showing up – or the board wising up – suggests the upside potential outweighs the downside risk.

On top of that, comparable should get easier.

There clearly are better companies to own, and surely risks remain, but given the revised thesis, at this point a yellow flag seems more prudent.

Moving on…

Paycom Getting Pounded

Paycom has slid 8% since it was first red-flagged here a few weeks ago. A good deal of the weakness followed a few disclosures...

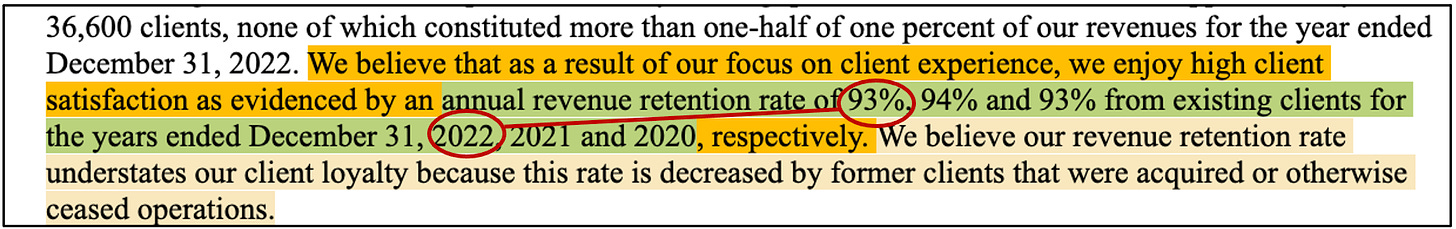

First, in its 10-K filed last week the company reported that its customer count barely budged over the prior year, rising to 36,800 from 36,600.

At the same time, its retention rate continues to slide, with the company disclosing that it slipped to 90% from 91% 2022.

But buyer beware… discrepancy alert: In its 2022 10-K, Paycom reported that its retention rate for 2022 was 93%, not the 91% reported in 2023…

Either way, the slip in the retention rate in 2023 was worse than it appears… and if not in 2023, then surely in 2022. Makes you wonder what other discrepancies there might be. (Revised: The company disclosed in its latest 10-K that it had modified how it calculated its retention rate, but that in itself is potentially a red flag.)

Also, be on the lookout for insider sales by CEO Chad Richison. I’m not going deeper because between seemingly serial 10b5-1 filings plus an amended 13-G and Form 4 filings by Richison and related entities – not to mention a barrage of footnotes – it’s too complicated for comfort and hard to say what’s really going on. I’d love to hear from readers who think they have untangled it.

Finally…

Inflection Point, Revisited

In last week’s “Inflection Point” report, I noticed that the overall performance of my Red Flag Alerts had started to deteriorate again – after the overall stock performance had risen by more than half from where they had been at their depths. At one point in recent weeks it was -13% versus -30% in November.

When I wrote Inflection Point it was -17%. As of Friday, -23%.

Interpret at will…

If you liked this, please click the heart button and feel free to share away.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

So true!! “Selling jeans and outdoor gear is far different than selling pool supplies, which can be quite technical and nuanced.”

Thanks Herb. Regarding Paycom, Warren Buffet won't buy anything he can't understand or unravel. Pretty smart rule.